In high watchmaking, January 1st has become more than just a new beginning. It is the day the "Crown" resets the global market.

Rolex’s annual price adjustment is now a structural part of the collecting experience. While a higher price tag is rarely celebrated, seasoned collectors understand the deeper signal: Rolex is raising the floor.

When the floor rises, every asset above it must reconsider its position—from pre-owned valuations and trade-in equity to the very definition of "entry-level" in 2026.

1. The 2026 Shift: Not Uniform, and Not Subtle

The key detail of this year's adjustment is that Rolex does not move the needle evenly. The increases follow a clear hierarchy of material and brand positioning.

Looking at the early 2026 global lists, we see a distinct trend:

-

In Europe: Steel models have risen modestly, while gold and platinum references have moved aggressively, with precious metals leading the jump (between 4% to 6% overall).

-

In the United States: The change is even sharper, with WatchPro reporting an average +7% increase. Steel hovers around +5.6%, while solid gold is pushing close to a +9% increase.

-

In Malaysia: The change is in line with major markets, solid gold models hiked aggressively +10%, while steel models were hiked modestly +6%.

The message is consistent: Rolex is intentionally widening the gap for the "jewelry tier," allowing its stainless steel professional models to follow in their wake.

As a Malaysian-based retailer, we see a unique interplay here. Our local pricing is often a reflection of "Price Harmonization"—Rolex’s effort to ensure a Submariner costs roughly the same in Kuala Lumpur as it does in London or Singapore after currency conversion.

| Material | Model | Reference | 2025 (RM) | 2026 (RM) | % Increase |

|---|---|---|---|---|---|

| Stainless Steel | Submariner | 124060 | 40,850 | 43,600 | 6.7% |

| Submariner Date | 126610LN | 45,850 | 49,100 | 7.1% | |

| Submariner Date | 126610LV | 48,150 | 51,500 | 7.0% | |

| GMT Master II | 126710BLNR Oyster | 47,650 | 51,000 | 7.0% | |

| GMT Master II | 126710BLNR Jubilee | 48,600 | 51,950 | 6.9% | |

| Daytona | 126500 | 68,550 | 73,000 | 6.5% | |

| Steel / Gold Rolesor | Datejust 36 | 126234 Jubilee | 40,850 | 43,850 | 7.3% |

| Submariner | 126613LB | 75,400 | 82,000 | 8.8% | |

| GMT Master II | 126713GRNR | 79,500 | 86,300 | 8.6% | |

| Yachtmaster 37 | 268621 | 69,000 | 75,100 | 8.8% | |

| Daytona | 126503 | 95,400 | 103,700 | 8.7% | |

| Solid Gold | Daytona | 126505 | 222,500 | 253,250 | 13.8% |

Rolex Retail Price Adjustment - Malaysia Market (Source: Rolex Malaysia)

Note: Prices shown are RRP (inclusive of Malaysian tax). Pre-owned and Market Prices may differ.

2. The Strategic Reset: Why Every Year?

There are three practical reasons for this regularity—and one overarching brand strategy.

The Practicalities:

-

Material Volatility: The costs of gold and platinum are dynamic. As a vertical manufacturer, Rolex prices these fluctuations into their annual cycles.

-

Global Parity: Rolex aims to prevent any single market from becoming a "cheap" destination for arbitrage. Annual resets harmonize prices across borders, ensuring a level playing field for collectors globally.

-

Distribution Control: When exchange rates shift, price harmonization prevents local stock from being drained by opportunistic global buying.

The Deeper Strategy:

-

Positioning: Rolex is continuing its long-term migration away from "attainable luxury" and toward a harder-to-enter, higher-floor luxury tier.

3. The Malaysia Reality: The New "Entry" has Moved

Even without quoting percentages, the repositioning is palpable in local retail numbers. The psychological bracket for "the start of Rolex" has fundamentally shifted.

Consider two iconic benchmarks in the current Malaysia pricing:

-

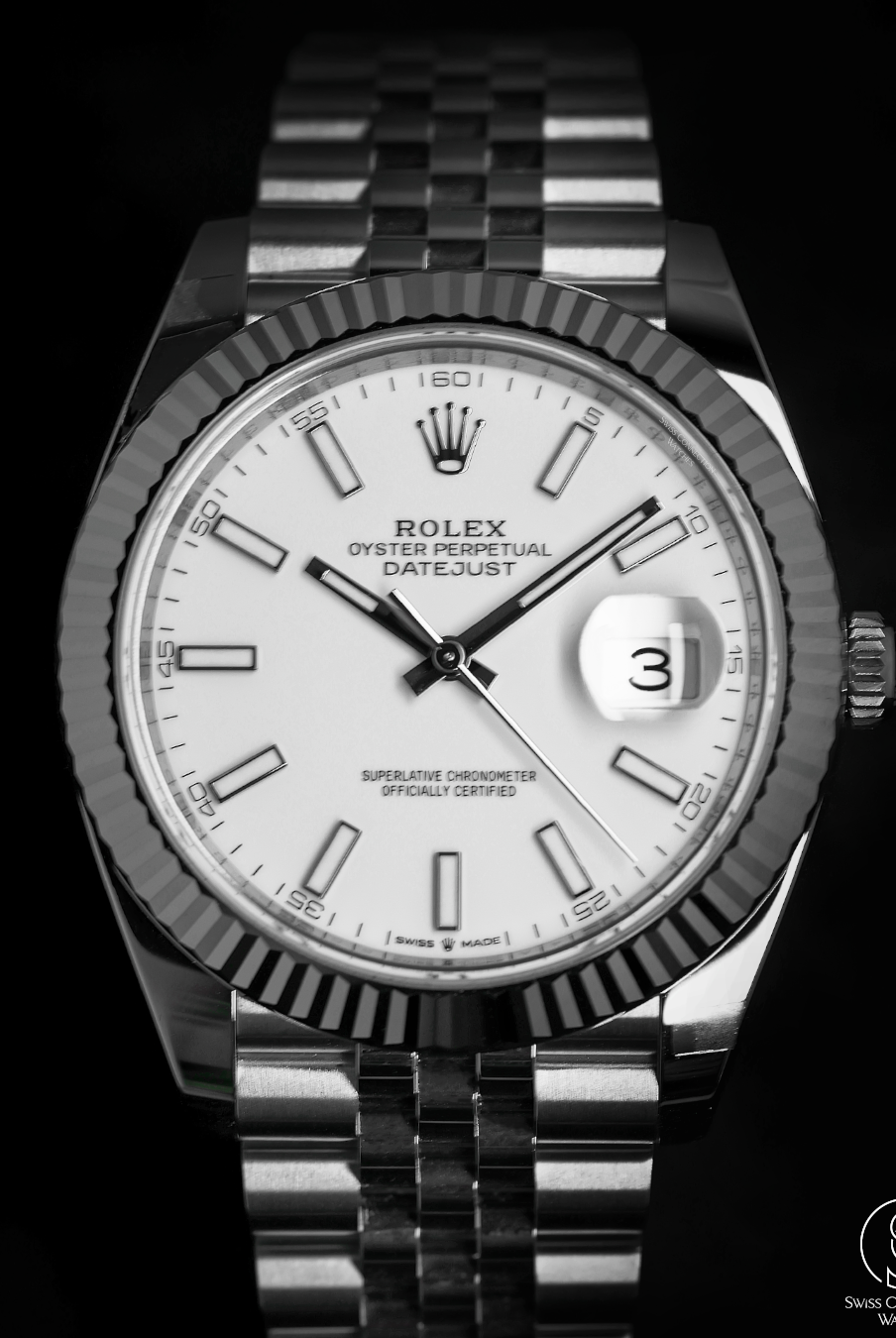

Submariner "No-Date" (Ref. 124060): Now sits at RM 43,600.

-

Oyster Perpetual 36 (Ref. 126000): Now sits at RM 27,250.

The "five-figure" watch (in USD terms) is no longer the exception for a professional model; it is now the standard.

4. MSRP vs. Market Access: The "Waitlist Tax"

Retail price is one thing; immediate ownership is another. While the official price list provides the baseline, the "secondary premium" remains a reality for the most coveted references.

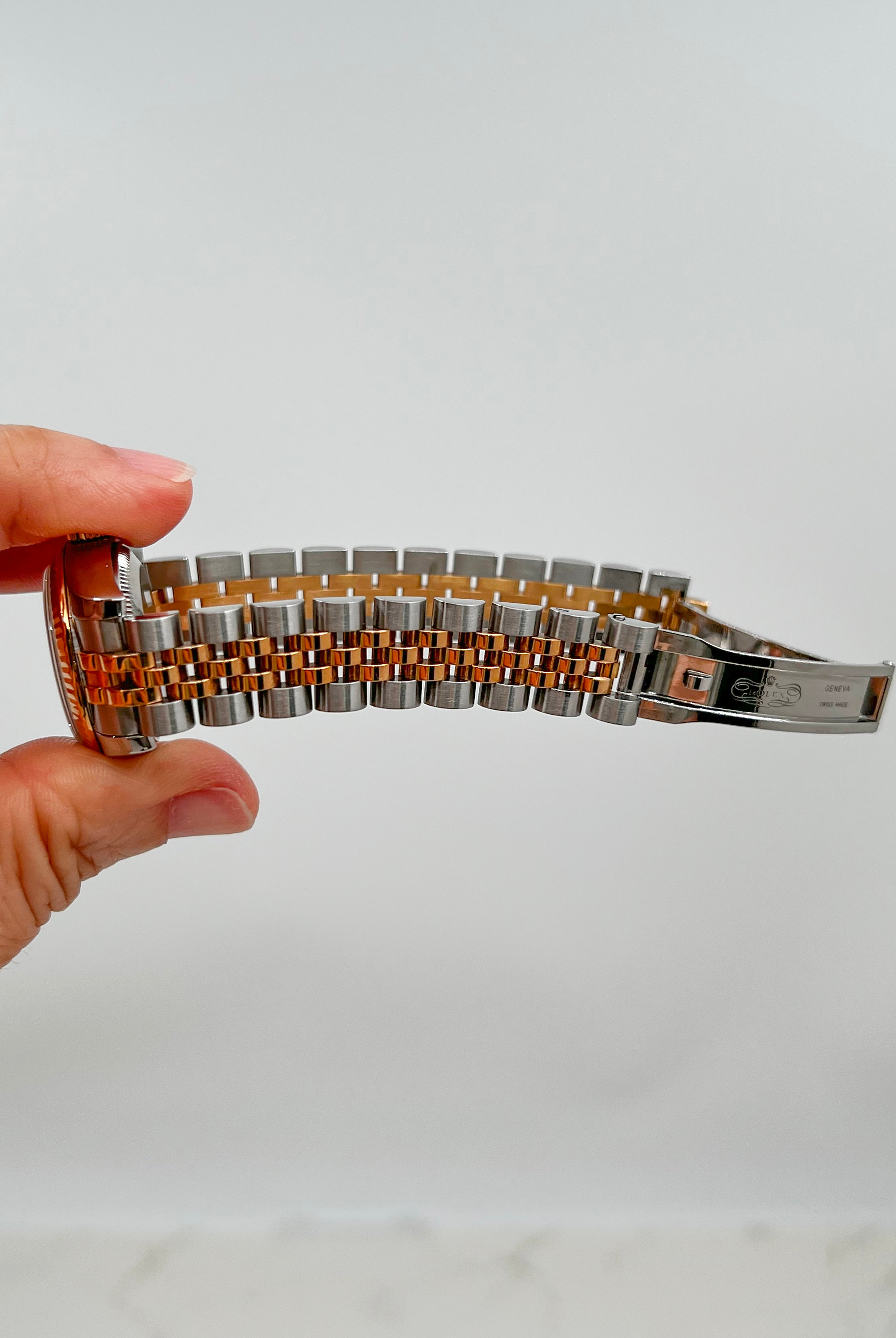

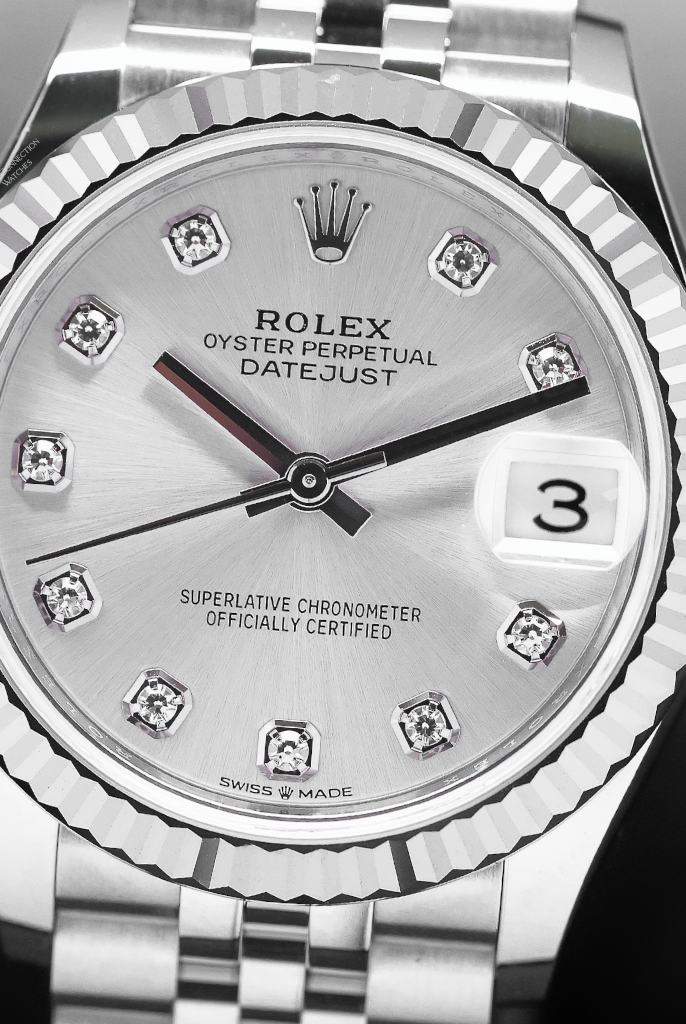

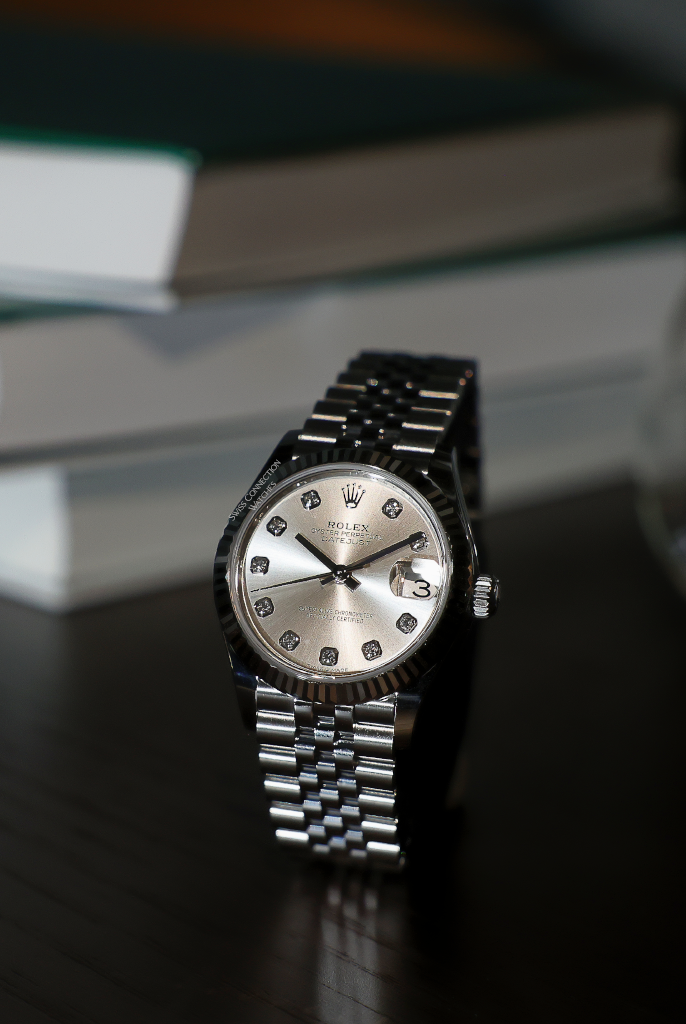

In the Malaysian market, this isn't restricted to professional "hype" watches like the Daytona or the "Pepsi" GMT-Master II. We are seeing a significant trend where the Datejust—traditionally the brand's cornerstone classic—regularly trades above MSRP in specific configurations.

Specifically, the Datejust 31, 36 and 41 with fluted bezels and Jubilee bracelets in high-demand colors like Mint Green, Blue, or even Diamond-set dials are effectively "waitlist pieces." For these models, the retail price is merely a suggestion for those willing to wait years; for those wanting the piece today, the market price reflects the high desirability and scarcity of these premium specifications.

5. Where the Smart Value Shifts: Neo-Vintage and Discontinued

As the retail floor rises, the collector’s opportunity often moves sideways rather than forward. This is why we are seeing a significant local pivot toward:

-

Modern Pre-Owned (6-Digit Series): For many Malaysian collectors, the best "entry" is now a pre-owned modern reference (e.g., a 2021-2023 Submariner or Datejust). These watches offer the current technology, ceramic bezels, and long power reserves, but can often be acquired immediately. While some still carry premiums, many configurations offer a "faster" value proposition compared to the compounding MSRP increases of buying brand new in 2026.

-

Five-Digit "Neo-Vintage" References: These offer classic proportions and a different tactile experience, often at a price point that harkens back to the "old floor."

-

Discontinued Models: These represent a fixed supply in an expanding market. As current MSRPs rise, the gap between a brand-new model and a recently discontinued "pre-ceramic" or early-ceramic model becomes an attractive entry point.

Closing Thoughts: The Cost of Waiting

A Rolex price adjustment isn't a reason to panic-buy, but it is a reminder that in this market, timing is everything.

-

Buying New (The 2025 Inventory Grace Period): While the 2026 price list is official, there is a narrow window for the savvy collector. Retailers like us often still hold curated 2025 stock—watches that are technically brand new and unworn, but still priced at the previous MSRP. This represents the last chance to acquire a current-generation reference at "yesterday’s price" before the 2026 adjustment fully permeates every corner of the market.

-

Buying Pre-Owned: The rising MSRP strengthens the logic of selective pre-owned acquisitions, particularly for references governed by supply constraints rather than trend cycles. As the new price floor rises, the secondary market for modern pre-owned watches often follows suit, making current holdings even more attractive.

-

If You Already Own: The higher floor is doing its job—quietly reinforcing the equity and long-term value of your collection.