A Buyer and Seller Perspective — Plus What We’re Seeing In-Store Right Now

When Rolex adjusted prices in early 2026, the spotlight immediately hit the retail list. New Retail Prices. New headlines. New “should I buy now?” conversations.

But retail is only half the story.

Last week (2nd week of January 2026), we took in a Royal Oak Offshore on trade for a Datejust 41 (126334 Blue Index on Jubilee). That’s the 2026 mood in one transaction: collectors are rotating out of ‘occasion watches’ and into the piece they’ll actually wear five days a week.

For collectors, the more useful question is what happens after the price increase—inside the pre-owned market, where real transactions, real preferences, and real liquidity reveal the truth. Pre-owned doesn’t move as a single wave; it moves in pockets.

1. Retail Moves Overnight. Pre-Owned Moves Selectively.

Rolex price increases are instant and uniform. The secondary market is neither. While a boutique changes a price tag in minutes, the secondary market reacts based on three distinct filters:

-

Speed: Highly liquid "Hype" models respond in days; others take months to adjust.

-

Configuration Matters: Dial, bezel, bracelet, and condition now dictate price more than the global MSRP percentage.

-

Liquidity vs. RRP: A 7% retail move does not automatically make every pre-owned reference worth 7% more tomorrow.

The smartest collectors aren’t asking “Did Rolex go up?” They’re asking: “Which references actually followed it?”

2. The 2026 Market Reality: Hype vs. What Actually Sells

In the first three weeks of 2026, we’ve seen a clear split between what people talk about and what they actually buy.

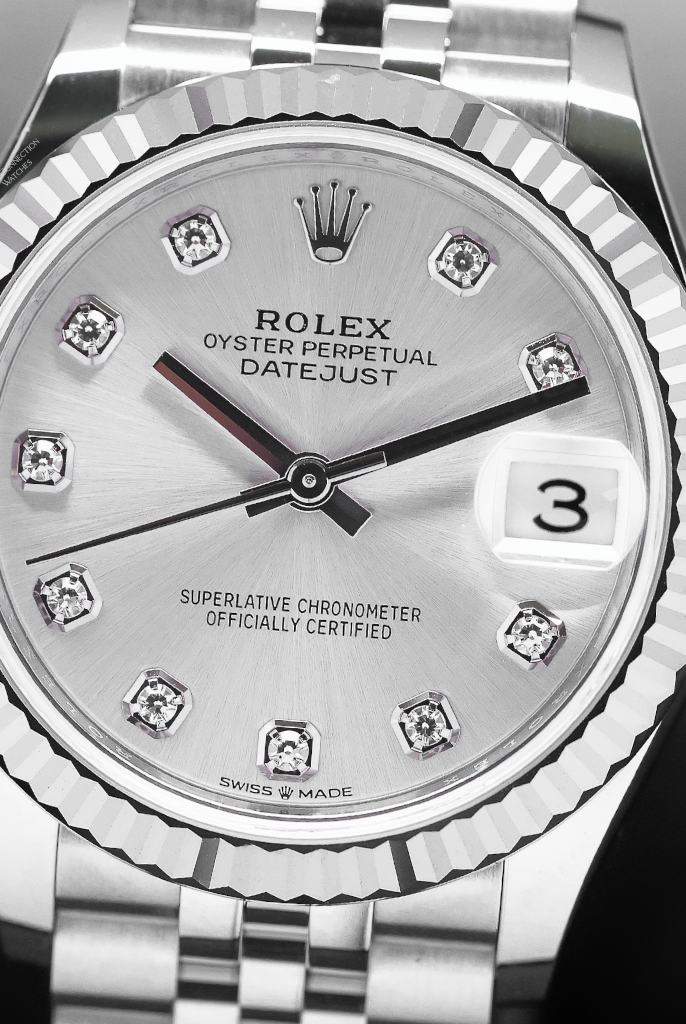

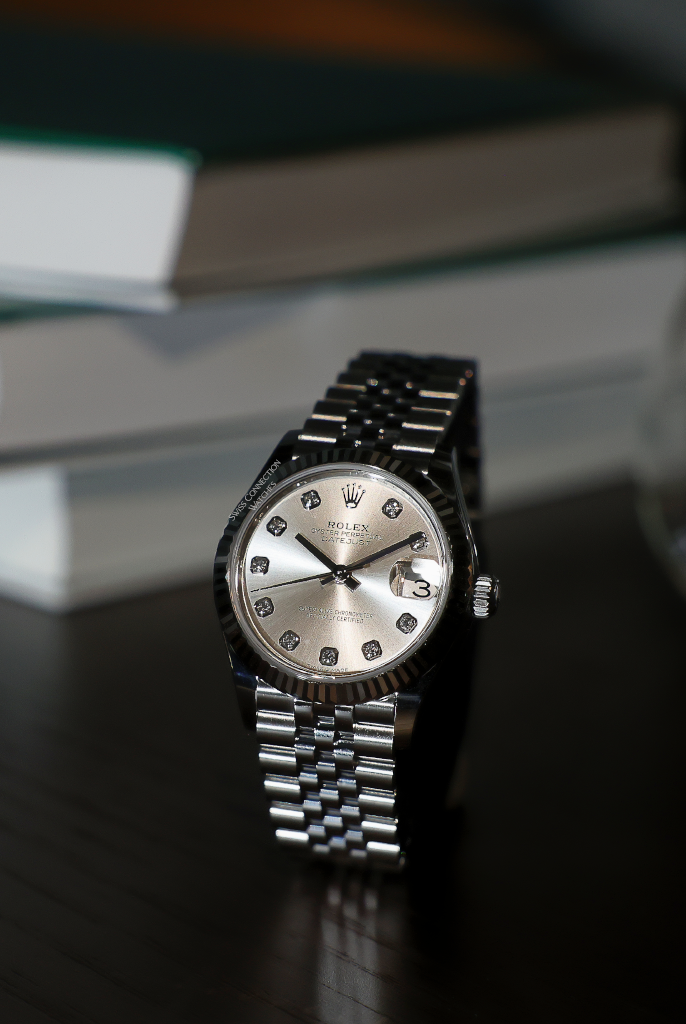

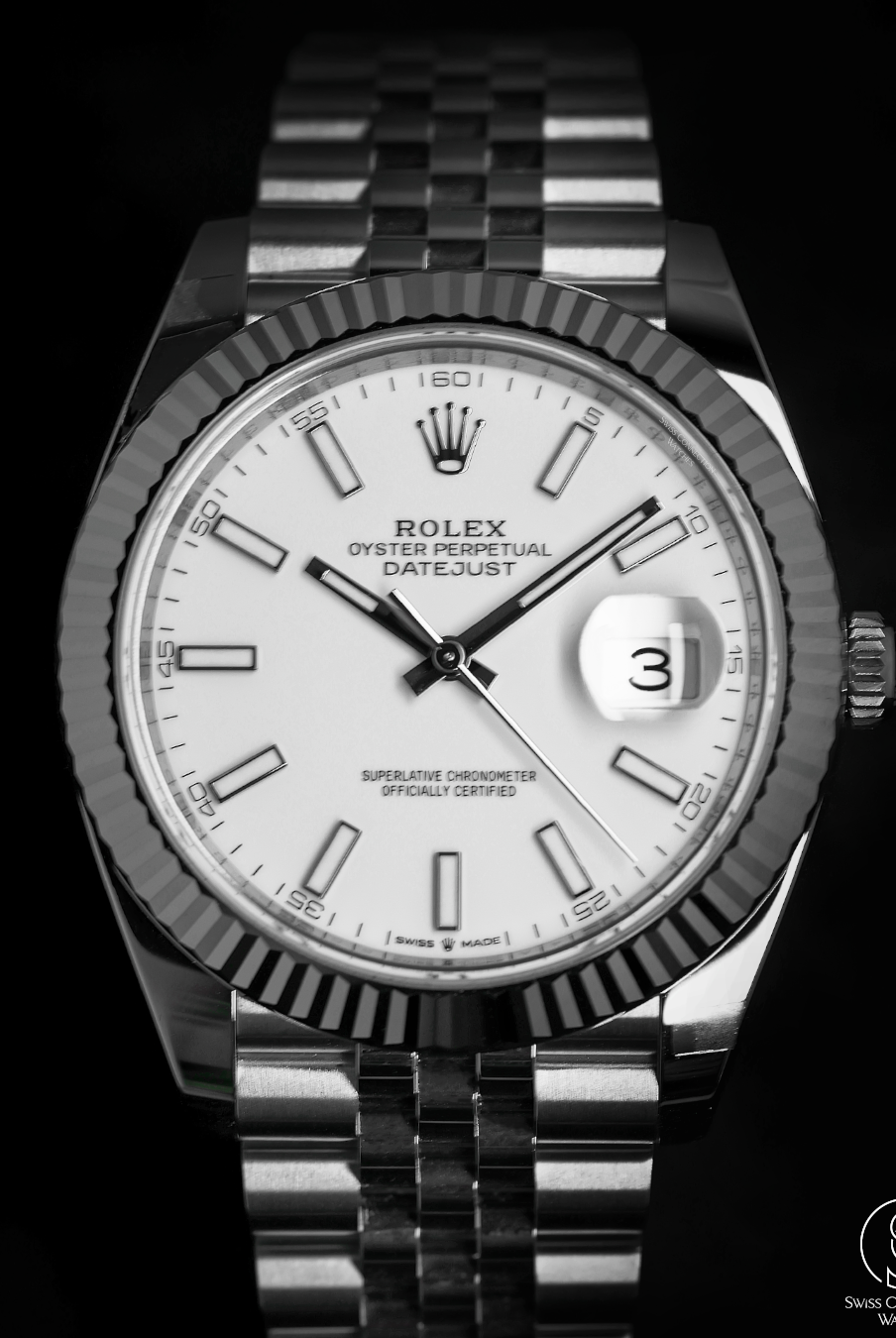

While the "Evergreen" steel-sport models (GMT-Master II, Daytona, Submariner) still dominate the online forums, the watches moving the quickest in-store right now are Datejusts. Specifically: Fluted bezel + Jubilee bracelet + choice dials.

|

Category |

Primary Choice Dials |

Configurations |

|---|---|---|

|

Men |

Blue, Green, & Dark Colors |

Index Dials |

|

Ladies |

Pink, Light Colors |

Roman Numerals, Diamond-Set Dials |

What’s more telling is that demand is no longer trapped in one “safe” size. We are seeing consistent movement across the entire spectrum: 28mm, 31mm, 36mm, and 41mm.

3. How the Pre-Owned Market is Segmenting

A) Evergreen Stainless Steel Icons — Structural Demand

Steel Professionals - GMT-Master II, Daytona, Submariner

These are the “blue-chips.” Retail hikes don’t create demand here — they reinforce the floor, especially for new or newer full-set examples. This segment rarely needs a story. The market already believes in the value, the liquidity, and the global buyer depth.

B) Professional Anchors — Predictable Value

Explorer I, Air-King, Explorer II These attract purists.

These attract purists. Pricing tends to stay anchored closer to RRP because the demand is quiet and consistent, not speculative. You don’t buy these to chase spikes — you buy them because they’re honest, durable watches that wear well and hold steady.

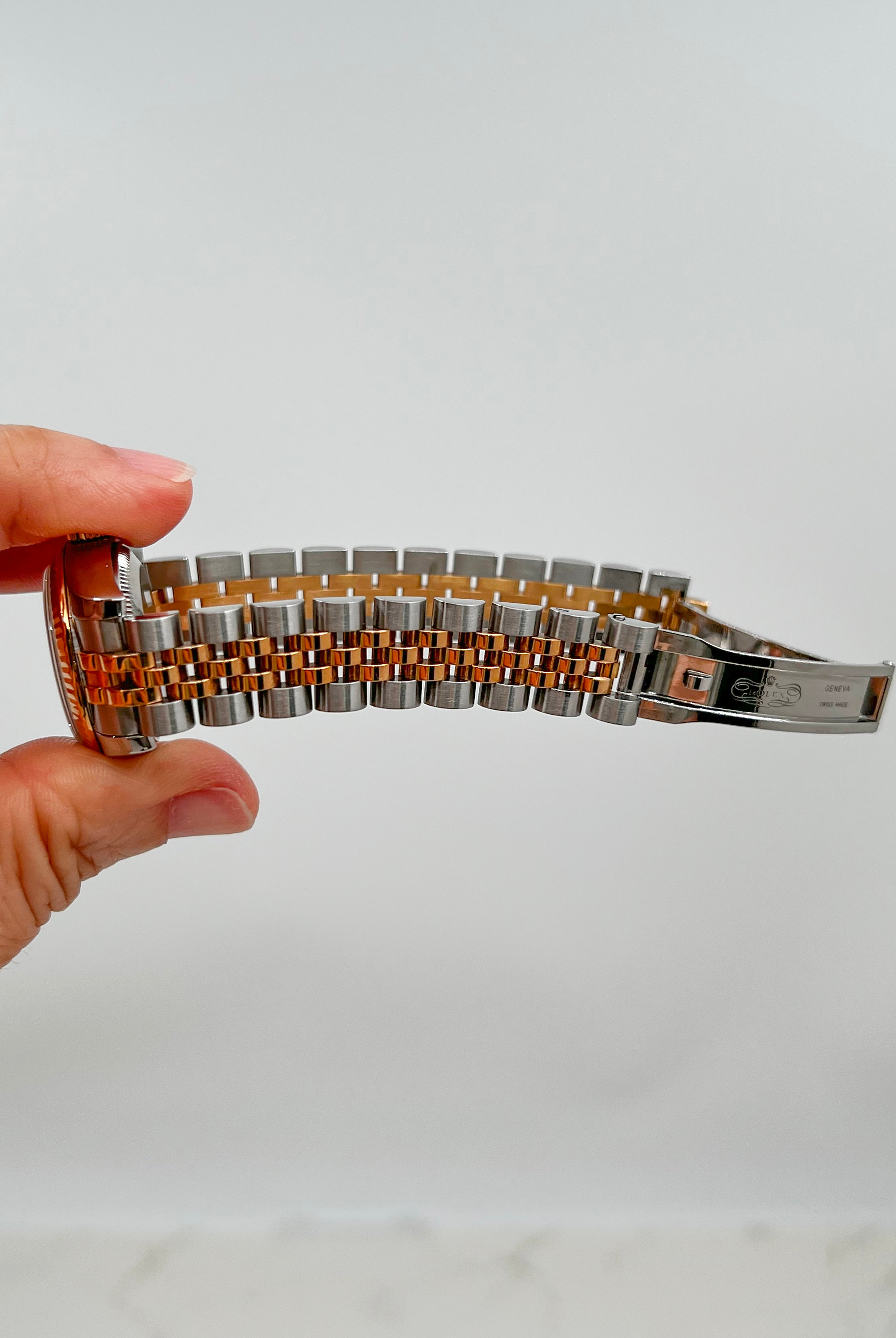

C) Rolesor Datejust — The Configuration Divide

-

The Winners: Datejusts that feel “complete” — Fluted bezel + Jubilee bracelet, especially with standout choice dials (and diamond dials in particular). These move because they hit the sweet spot: presence, versatility, and instant recognition.

-

The Laggards: Smooth bezel + Oyster bracelet configurations still struggle — unless paired with genuinely strong dials. In 2026, Rolex two-tone doesn’t automatically mean “more desirable.” The configuration decides the outcome.

D) Solid Gold — The Value Gap

Gold’s retail climb hasn’t been mirrored evenly in pre-owned. Most solid-gold sports pieces still need the right spec to justify the price — and even then, demand is selective. The exceptions remain the usual rule: rare dials (especially certain Daytonas) hold strength, while many standard configurations continue to trade below retail.

4. The Buyer Perspective: Identifying Opportunity

A price increase doesn’t simply "lift everything" like a rising tide; it often creates a temporary friction that savvy buyers can exploit. The secondary market is currently presenting three distinct windows of opportunity:

-

Exploiting the Price Lag: Secondary market prices don't adjust at the stroke of midnight. There is often a 30-day "price lag" where pre-owned inventory is still priced against 2025 MSRPs.

-

The Cost of Convenience: As retail prices climb, the premium paid for immediate access on the secondary market feels smaller. If a GMT-Master II increases by 7% retail, the "gap" between the impossible waitlist price and the immediate secondary price shrinks.

-

Quality Flight: When prices rise, buyers naturally become more demanding. We are seeing a "flight to quality" where the price spread between a naked watch and a mint, full-set example is widening. The real opportunity lies in securing those "Collector Grade" sets now, before the secondary market fully recalibrates its floor to match the new boutique reality.

5. The Seller Perspective: Realism Wins

The 2026 increase supports the narrative that your watch is more expensive to replace now. However, the market rewards Recognizable references, Desirable configurations, and Full Sets. If you own a "correct spec" Datejust or a blue-chip sports model, the market moves quickly. If you own an oversupplied or less desired setup, your pricing must meet market reality, not the boutique headlines.

6. Final Thoughts: Value Beyond the Sticker

At the end of the day, spreadsheets and market analyses serve only one purpose: to get you to the point of purchase with confidence. But once the watch is on your wrist, the numbers should fade into the background.

We often get caught up in the "price" of a Rolex because it feels like a tangible way to measure value. But if you’re buying a watch primarily as a line item on a balance sheet, you’re missing the point of the Crown. You buy a Rolex to wear it. You buy it to mark an achievement, to celebrate a milestone, or simply because the way the light hits a sunray dial brings you a quiet sense of satisfaction every time you check the time.

The 2026 price hike is a reality of the market, but it shouldn't be the reason you buy—or don't buy—a watch you love. The market value only matters on two days: the day you buy it and the day you sell it. On every day in between, the only value that matters is the joy it brings you while you wear it.

Ten years from now, you won’t remember the 6% adjustment or the "lag" in secondary pricing. You’ll remember the places that watch has been with you. Buy for the soul, not the speculation; the numbers will take care of themselves.

Further Reading from the Journal

The 2026 Rolex Price Adjustment: Understanding the New Floor and What it Means for Collectors

Watch Predictions for 2026: The Return to Intention

Rolex Datejust in 2025: Why 31mm and 36mm are Redefining the Perfect Fit